What Is the Best Percentage for Arizona Withholding

The employee can submit a Form A-4 for a minimum withholding of 08 of the amount withheld for state income tax. My salary is 86000.

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Tax Bracket Single Marginal Tax Rate 0 259.

. For state income taxes Arizona offers seven withholding percentage options. Rates are a percentage of gross taxable wages Percentage Rates 08 13 18 27 36 42 51 2019 Forms W-2 due January 31 2020 Employers must file the calendar year 2019 Form A1-R Arizona Withholding Reconciliation Return and Forms W-2by January 31 2020. How much should I have withheld for Arizona state taxes.

Individuals who do not pay income taxes through automatic withholding may be required to pay their Arizona Income Tax quarterly using Form 140ES Income Tax Estimate. To compute the amount of tax to withhold from compensation paid to employees for services performed in Arizona an employee must complete Arizona Form A-4 Arizona Withholding Percentage Election within the first five days of employment. Choosing the 27 percent withholding option means youll owe an additional 028 percent 112 in April if you wish to have a.

The percentage options are 08 13 18 27 36 42 and 51. Let me know if you need any help with the determination. I started working on november of this year and my salary is 70k if that helps.

As you can see your income in Arizona is taxed at different rates within the given tax brackets. If the employee does not complete the form the employer must withhold Arizona income tax at the rate of 27 until the. The Basics of Withholding Withholding refers to an employers responsibility to pay each employees estimated income tax by directing a percentage of gross taxable wages to the government tax office rather than paying it directly to the employee.

And 450 on income beyond 163632. Yes - that would be the correct withholding percentage with. Married Filing Jointly Tax Brackets.

417 up to 163632. State income tax definitions conform to the federal tax provisions AZ Stat. 334 up to 54544.

This is what you need to pay in full and on time each quarter in order to get a FUTA tax credit. Note that these are marginal tax rates so the rate in question only applies to the income that falls within that bracket. Theres not enough information in this inquiry as to what to do.

Arizona state income tax rates are 259 334 417 and 450. The Arizona income tax has four tax brackets with a maximum marginal income tax of 450 as of 2022. Arizona Tax Brackets for Tax Year 2020.

I have to fill out the state W4 form and am having trouble choosing the withhold from gross taxable wages at the percentage checked The percentage options are 08 13 18 27 36 42 and 51. When you need What Percentage Should I Withhold For Arizona State Taxes dont accept anything less than the USlegal brand. Arizona Married Filing Jointly Tax Brackets TY 2021 - 2022.

Your tax liability is 1195 or 298 percent of your income. Any income over 163633 for single and 327264 for married filing jointly would be taxes at the highest rate of 450. The Forms Professionals Trust.

An employee required to have 08 deducted may elect to increase this rate to 13 18 27 36 42 or 51 by submitting a Form A-4. Withholding percentage options for wages paid. That rate varies somewhat between cities and counties but no county in Arizona has an effective property tax rate higher than 101 which.

On the first 7000 each employee earns Arizona employers have to pay unemployment insurance of between 008 to 2093. Filing as a single person in Arizona you will get taxed at a rate of 259 on your first 27272 of taxable income. Hello I just got a new job in arizona and my employer is asking what percentage to choose for withholdings.

Tax Bracket Tax Rate. Time to Write Those Paychecks. This Arizona bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

All new employers should use a flat rate of 20. Or you may estimate your percentage using Arizona tax tables see page 54 - httpwwwazdorgovLinkClickaspxfileticketp38IDhkyaZI3dtabid257mid878. Free Preview What Is The Best Percentage For Arizona Withholding All forms provided by US Legal Forms the nations leading legal forms publisher.

Generally compensation that is subject to federal withholding is also subject to state withholding. What is the Married Filing Jointly Income Tax Filing Type. I am new to arizona and recently got a job.

Income Tax - Form 140ES Instructions. Arizona Income Tax Brackets. What is the best percentage for Arizona withholding Reddit.

Employers may withhold Arizona taxes from the wages of residents earned outside of Arizona as a service to those employees. The average effective property tax rate total taxes paid as a percentage of home value is 062. Arizona state income tax brackets and income tax rates depend on taxable income tax-filing status and residency status.

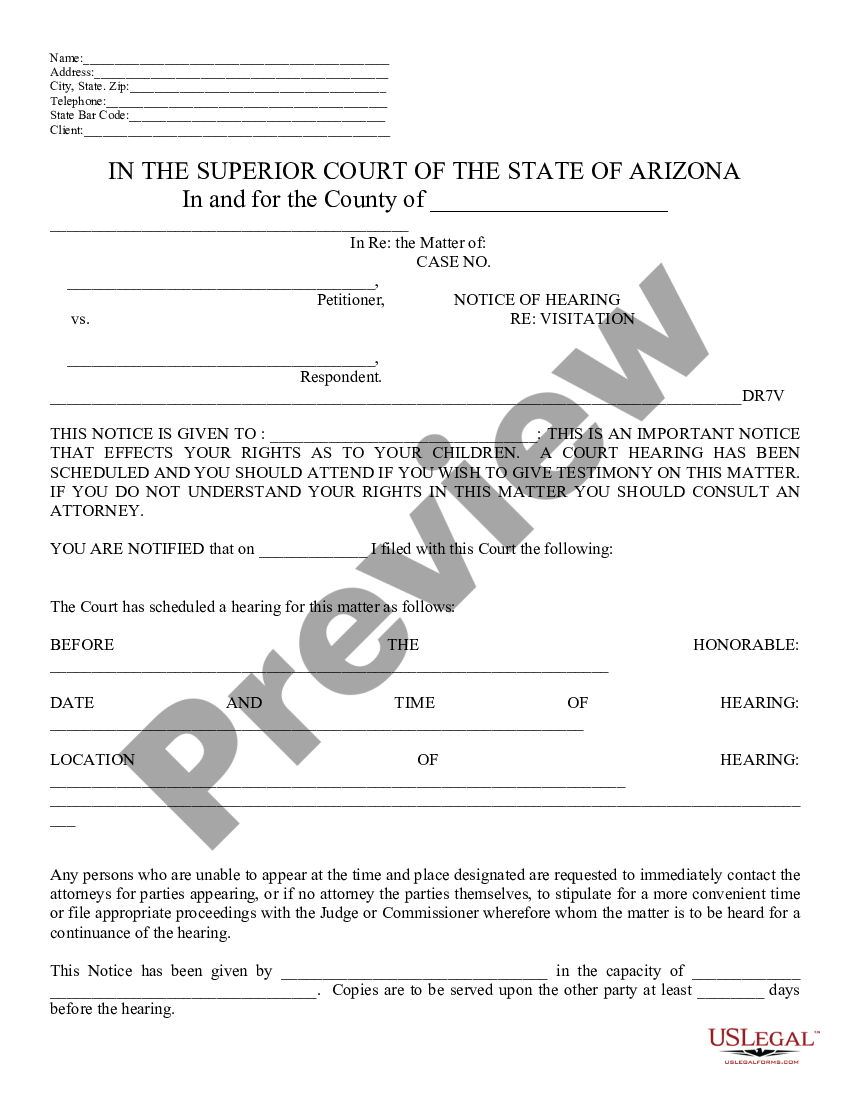

Arizona Notice 411 Arizona Withholding Percentage How To Choose Us Legal Forms

Arizona Withholding Percentage How To Choose A 4 Form

How To Calculate Arizona Income Tax Withholdings

Tax Withholding For Pensions And Social Security Sensible Money

Comments

Post a Comment